Some Ideas on Amur Capital Management Corporation You Should Know

Table of ContentsGetting My Amur Capital Management Corporation To WorkAmur Capital Management Corporation - The FactsNot known Incorrect Statements About Amur Capital Management Corporation Excitement About Amur Capital Management CorporationAmur Capital Management Corporation Things To Know Before You Get ThisThe Single Strategy To Use For Amur Capital Management Corporation

Not just will the home boost in value the longer you have it, however rental prices typically comply with an upward pattern also. This materializes estate a rewarding lasting investment. Real estate investing is not the only way to spend. There are lots of other financial investment alternatives offered, and each features its own collection of toughness and weak points.

A Biased View of Amur Capital Management Corporation

Wise investors might be rewarded in the form of admiration and dividends. Given that 1945, the average large supply has actually returned close to 10 percent a year. Supplies truly can offer as a long-term cost savings automobile. That claimed, stocks could equally as easily diminish. They are by no means a certainty.

That claimed, real estate is the polar contrary relating to particular aspects. Web profits in genuine estate are reflective of your own activities.

Any type of cash got or shed is a direct outcome of what you do. Supplies and bonds, while typically abided with each other, are fundamentally different from one another. Unlike supplies, bonds are not rep of a risk in a company. Consequently, the return on a bond is taken care of and does not have the possibility to value.

Get This Report on Amur Capital Management Corporation

The genuine benefit property holds over bonds is the time frame for holding the investments and the rate of return during that time. Bonds pay a set price of rate of interest over the life of the financial investment, thus purchasing power with that said rate of interest goes down with inflation over time (alternative investment). Rental home, on the various other hand, can produce higher rental fees in periods of greater inflation

It is as straightforward as that. There will certainly constantly be a need for the priceless steel, as "Fifty percent of the world's populace thinks in gold," according to Chris Hyzy, chief financial investment officer at U.S. Depend on, the private wealth management arm of Financial institution of America in New York City. According to the World Gold Council, demand softened in 2014.

Amur Capital Management Corporation Fundamentals Explained

Recognized as a relatively risk-free commodity, gold has established itself as a vehicle to enhance financial investment returns. Some do not also take into consideration gold to be a financial investment at all, instead a bush against rising cost of living.

Certainly, as safe as gold might be thought about, it still stops working to remain as attractive as realty. Here are a few factors capitalists like property over gold: Unlike actual estate, there is no funding and, consequently, no space to utilize for development. Unlike realty, gold suggests no tax obligation advantages.

The Best Strategy To Use For Amur Capital Management Corporation

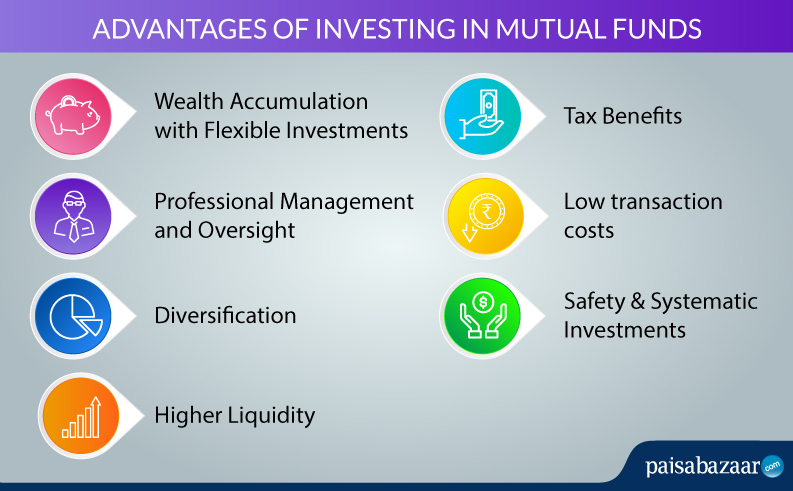

When the CD matures, you can accumulate the initial financial investment, together with some passion. Deposit slips do not appreciate, and they have actually had a historic average return of 2.84 percent in the last eleven years. Real estate, on the other hand, can value. As their names recommend, shared funds include finances that have been pooled with each other (accredited investor).

It is just one of the easiest methods to diversify any profile. A common fund's efficiency is always determined in regards to overall return, or the sum of the change in a fund's internet property worth (NAV), its dividends, and its capital gains distributions over an offered period of time. Much like stocks, you have little control over the performance of your possessions.

Positioning money into a common fund is basically handing one's investment decisions over to a specialist money manager. While you can pick your investments, you have little claim over just how they execute. The 3 most typical methods to purchase actual estate are as adheres to: Acquire And Hold Rehab Wholesale With the worst component of the recession behind us, markets have gone through historical admiration rates in the last 3 years.

Amur Capital Management Corporation Fundamentals Explained

Getting low does not indicate what it made use of to, and financiers have identified that the landscape is changing. The spreads that wholesalers and rehabbers have come to be accustomed to are starting to summon memories of 2006 when worths were traditionally high (mortgage investment). Naturally, there are still countless chances to be had in the globe of turning property, yet a new leave technique has become king: rental residential or commercial properties

Or else called buy and hold homes, these homes feed off today's admiration prices and you can check here profit from the reality that homes are extra expensive than they were simply a couple of short years ago. The principle of a buy and hold exit strategy is straightforward: Capitalists will certainly look to increase their lower line by renting the property out and collecting monthly capital or simply holding the home until it can be cost a later day for an earnings, naturally.